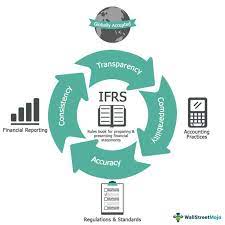

Introducing IFRS

International Accounting Standards Board (IASB) and IFRS Foundation publish International Financial Reporting Standards (IFRS) as accounting guidelines. In order to understand the company’s financial statements and to compare them with other countries, they are build with the standard terminology to describe the company’s financial performance and position. They govern some of the particular transactions and events to maintain a report statement of the company. IFRS follows Relevance, Reliability, Comparability, and Clarity as its principles.

Objective of IFRS

The main objective of IFRS are

- IFRS enables many entities to get pitched into the international capital markets. It also focuses that other users/entities with high-quality, transparent, and comparable information in financial statements and other financial reporting to guide economic decision-making. It is treated to be the major objective of IFRS.

- To encourage the use and application of those standards to meet its objectives.

- Taking into account, as convenient, the specific needs of small and medium-sized entities and emerging economies.

- Aiming to achieve high-quality solutions by bringing together national accounting standards and international accounting standards.

- Establish the accounting statements universally for the companies.

- It can be easier for the stakeholders to analyze the financial statements of any entity/company irrespective of the business location by establishing the accounting rules.

- Enable the account statements to be transparent in order to make them credible.

- Assisting the appropriate category of the entity/company and reporting the financial data statements accordingly to maintain the high quality in the market.

- Make the task easier by comparing it with the international market and analyzing the growth of the entity.

Let us include some of the scopes of IFRS along with the objectives of IFRS

- Unless IFRS is not amended or withdrawn, all the International Accounting Standards(IASs) and interpretations issued by former IASC and SIC continue to be applicable.

- IFRS is applicable for generic-purpose financial statements and other financial reporting by profit-oriented entities like in the commercial, financial, industrial, and some other activities of the legal forms.

- Few non-profitable entities also find IFRS relevant.

- Normally financial statements are proposed to meet the frequent needs of creditors, shareholders, employees, and at most information on the entity’s financial performance and position as well as on cash outflows.

- Financial reports containing information other than the financial statements are interpreted as a complete series of financial statements to enhance the user’s ability to make sound business decisions.

- IFRS is applicable to the individual as well as consolidated financial statements.

- Usually, financial statements involve a statement of financial status, overall income, cash flows, equity changes, accounting policy summary, and some explanatory notes. Income statement when presented separately according to IAS 1(2007), becomes a part of a complete set of financial statements.

Mandatory rules of IFRS

IFRS has a set of mandatory rules for some of the business components of specific financial statements like –

- Statement of Financial position – IFRS includes mandatory guidance on how to prepare and present financial statements.

- Statement of Comprehensive income – The statement of comprehensive income means the preparation of the income statement. All the income sources can have a single statement.

- Statement of changes in Equity – Another name for a Statement of Changes in Equity is the statement of retained earnings. Based on the opinions it includes more or less of the retained earnings over a certain period.

- Statement of the Cash Flow – It is about the cash transactions in finance, investment, and operations.

Importance of IFRS

- Manipulation check on the financial statements – IFRS keeps a track of the manipulation allied with the figures related to the financial statements. This can boost the consistency in the measurement of the recognition of the financial statements.

- Global uniformity and comparability – IFRS encourages the economy by establishing uniformity, harmony, and comparability to prepare financial statements.

- Foreign investment tumble – IFRS and IASB together give a guarantee for the foreign investors to ease the direct flow or indirect flow of foreign investment across the world.

- Encourages the accountability and transparency of financial statements prepared by the entities.

- It is useful when the business is spread across the world as there can be different methodologies and rules to prepare the documents. Hence, it is the improvement in the level of comparability between the transparency level and financial statements.

Additional benefits of IFRS

- IFRS enhances accountability by contracting the information gap between capital providers and the ones who leased their money.

- Based on the principles they have set certain standards to achieve the specific goal at a reasonable estimation of accomplishment of the task. This enhances the freedom of the business to adopt IFRS, resulting in ready financial statements and results.

- IFRS helps investors to categorize the risks and opportunities by increasing the allocation of capital across the globe and also contributes to the economic capacity of the entity. For companies, single-use generally reduces the cost of capital and international reporting costs.

- IFRS substantially provides consistent financial information improving the comparability of the business entity

- All most all of the world’s stock exchanges seek IFRS help with a financial reporting framework

- Improved comparability of the company’s financial information and better communication with stockholders decrease investor uncertainty, reduce risk, improve market efficiency, and eventually decrease capital costs

- Cross-border trading barriers due to security reasons are eliminated by IFRS to ensure transparent financial statements

- IFRS is used to manage the reporting of the internal purposes to improve the consistency and quality of management information needed to make efficient and effective timely decisions for the entity

- Strategic improvements in the financial processes and systems of the entity in the condensed cost for the long term are maintained by adopting IFRS

- Universally understandable and comparable new relationships with the customers and suppliers across the borders of the countries are managed by IFRS financial statements

- IFRS has a positive effect on strengthening the company’s position with the negotiable credits and less borrowing cost

- IFRS has absolute risk evaluations with less risk of having a financial advantage

- IFRS allows multinational entities to have a common accounting language by improving the management reporting and decision making.

Standard IFRS settings

- Meetings of the Board are broadcast live from the main office

- Deliberations of the Board are guided by the papers of agendas

- After meetings, summaries of discussion and decisions are published, and

- Also, the letters received regarding the consultation documents are published.

You can learn more about IFRS and its objectives of IFRS by joining the top-ranked institute “Henry Harvin”.

The IFRS course curriculum at Henry Harvin is designed to prepare IFRS exam usually conducted for a global career by ACCA( Association of Chartered Certified Accountants) in the finance firm.

Following candidates can select Henry Harvin

- CA, ICMA, CS, and some more financial professionals

- Financial professionals with at least minimum-qualification

- Accounts managers

- Finance managers

- MBA professionals in Finance

- Private firm professionals

9 in 1 course

- 75 hours of online interactive sessions, with 20+ hours of recording sessions

- Facility to work on projects related to Income tax, Financial reporting, and many others

- Internship conducted to gain practical knowledge

- 100% placement assistance support

- E-learning facility using required tools and techniques

- Regular Bootcamp sessions are conducted

- Free and easy access to the Hackathons

- 1-year Gold membership with Henry Harvin

Why select Henry Harvin

- For a better understanding of the IFRS Framework

- Practical knowledge with multiple practices in financial reporting

- A better understanding of the disclosure requirements

- Learn to Earn Per Share

- Knowledge acquisition events after reporting sessions

- Gain better knowledge about the financial statements and operational instruments

Teaching Methodology at Henry Harvin

- Live Projects – Live projects are included in the course curriculum as part of the training tenure to develop the experiential skills of the participants. And to get a better understanding of the conceptual and practical insights.

- Exclusive coaching – Multiple techniques aligned to the GCAO pedagogy and are focused to look at the action-oriented outcomes from the training.

- Perfect engagement – Participants are engaged throughout the training in preparing presentations, group activities, brainstorming, and hands-on experience on both the statistical and non-statistical technical tools. Here the focus is to value the creation.

- Trainers at Henry Harvin are well qualified and certified with the professional knowledge of the basic objectives of IFRS

- Almost more than 300+ lectures are delivered by the expertise in specific domains at Henry Harvin

Basic concepts related to IFRS – Financial, Capital, and Physical maintenance

- Capital Maintenance – Capital maintenance states that a profit has to be accounted for only if the company has maintained its equity accordingly during the financial year.

- Financial Capital Maintenance – The concept of Financial Capital maintenance states that a company can earn a profit only if its net asset amount at the end of a certain period exceeds the amount it was at the beginning. This must not include the inflow and outflow of the company like distributors and contributors.

- Physical Capital – Physical Capital increases productivity by affecting economic growth and potential output.

Differences between GAAP (Generally Accepted Accounting Principles) and IFRS

- GAAP is usually used in U.S companies for accounting and financial reporting whilst IFRS is the independent non-profit organization for setting accounting and financial reporting standards.

- IFRS is an international alternative to GAAP which is established by the International Accounting Standards Board (IASB)

- GAAP has a Last In First Out (LIFO) approach as an inventory cost method whilst it is restricted by IFRS

- Research and development charges may be expensive under GAAP whereas under IFRS they are capitalized and amortized over multiple time intervals

- GAAP makes sure that the certain write-down amount can not be reversed under any asset being increased. Whilst IFRS can reverse this write-down amount easily.

There is a huge demand for IFRS professionals in India as more and more companies are competing for international standards. IFRS professionals with a better understanding of the objectives of IFRS are in huge demand and are highly recruited by the Indian companies to have better prospects for their businesses.

Requirements for IFRS professionals in the entity

- In the banking and financial sectors

- Non-banking and non-financial sectors listed under the guideline of IFRS

- Counseling companies offering accounting and financial services

- In progression to the IFRS standards, IFRS experts can start their private consulting firms to advise the client

- IFRS professionals can work as IFRS trainers in educational or financial industries.

Companies following IFRS have to follow the same rules and standards in preparing financial statements as per the international market. IFRS maintains the uniformity of the financial statements across multiple firms and nations. And it is beneficial to a business in a way that investors can trust and invest by seeing companies’ market transparency and following standard accounts and financial information.

Conclusion

Hence IFRS is the set of guidelines and rules for every firm to adhere to make sure that the financial statements of the respective firm remain consistent across companies around the world. Also, the objectives of IFRS determine the company’s transactional record statements and ensure that the financial statements of the firm are transparent and credible. Therefore, the objectives of IFRS will be helpful in making decisions about the company’s financial records in the world accordingly. Additionally, IFRS prepares business financial statements using four fundamental principles of relevance, clarity, comparability, and reliability.

FAQ’s

Ans. The company should follow the objectives of IFRS as it will be helpful to maintain transparency and comparability to the financial statements.

Ans. There are many institutes available to learn the IFRS.

Ans. The basic principles of IFRS are clarity, comparability, relevance, and reliability.

Ans. Of course, IFRS-certified professionals are preferred in the MNC as well as in any firm across the countries.

Ans. Yes, they apply to any organization.

Recent Comments